The UK’s ice age isn’t over yet. What started as a tentative revival of the frozen category became a full-scale revolution during Covid and the ensuing lockdowns. Shoppers stuffed their freezers with chips, fish, pizza and other long-lasting goods that would help recreate out-of-home dining.

Now that hospitality is back in full swing, frozen’s growth has slowed. It’s added a modest £12.5m across the six sectors in this report, as the substantial value gains in frozen potatoes, fish and desserts were moderated by declines elsewhere in the category.

Nevertheless, that’s still a sterling performance, insists British Frozen Food Federation CEO Richard Harrow. The category has clearly broadened its base of loyal fans following 2020’s stockpiling – which helped opened many shoppers’ eyes to the benefits of frozen. Misplaced notions about lower quality have been dispelled, he says.

“The whole perception that frozen food is highly processed: it’s not. When you freeze a product to keep it, you don’t need so many additives,” Harrow stresses.

Last year saw many shoppers “moving into fish and pizza and savoury, and they were genuinely delighted with some of the quality” he adds, pointing to supplier efforts to improve products over recent years.

“We have seen a quality lift in frozen food over the years, whether that’s peas being processed in even shorter times or better quality, sustainable fish. The whole market has improved,” Harrow adds.

Such efforts have helped elevate frozen food “from an emergency back-up to a preferred format” says Sarah Koppens, marketing director for Birds Eye, Aunt Bessie’s and Goodfella’s.

“Shoppers’ newfound respect for the frozen aisle has reminded them what the frozen category has to offer – convenience, less waste, nutritional benefits and value for money among many others. And all without compromising on quality or taste.”

As she suggests, growing awareness around the issue of food waste is increasingly working in the favour of frozen food.

For retailers, it “can help eliminate the in-store wastage that is inevitable in the fresh and chilled sectors when a product reaches its sell by date, and for the consumer it means they can reduce food waste in the home”.

But as with all categories, taste is the main driver of purchase. And those credentials have been communicated through a growing number out-of-home-style options.

In fact, foodservice giants Greggs, TGI Fridays, Pret a Manger, Leon and Harry Ramsden’s added a total of £22.3m across the six sectors included in this report.

The big brands similarly cashed in on restaurant-inspired lines. Take McCain, with its £14.2m gain – the largest absolute rise across all five savoury sectors.

The gains come after the frozen potato supplier added Leon-esque Waffle Fries in September 2020. That was followed in March 2021 by the Flavour Maker range, comprising Smokey BBQ Fries, Garlic & Herb Chimichurri Skin-on Fries and Spicy Chilli Chipotle Deep-Ridge Chips.

As with posh potatoes, fancy fish also made gains. Young’s Gastro, for instance, added £3m, with the brand’s category insight director, Iain Lowrie, crediting “a return to fewer, bigger shops placing greater emphasis on meal planning and the importance of the freezer”. That has combined with “new shoppers to the category looking to cater for wider meal occasions, including lunchtime and restaurant-quality at-home dining options” he adds.

Similarly, Whitby Seafood says it achieved a 17.2% value gain by bringing “restaurant quality to the frozen shelves”.

It’s much the same story in pizza, where restaurant brand Zizzi stormed the top 10 and New York takeaway-inspired Goodfella’s grew by 6.5%. “We’re currently seeing the eat-at-home, takeaway-style pizza category growing in volume,” says Koppens. Hence, Goodfella’s latest NPD, Mini Stonebaked Pizzas that take 11 minutes to cook, making them the “fastest oven-cooked pizza snack in the market”.

Long-life resilience

The benefits of frozen food don’t end there, either. There’s also its relative resilience to the ongoing supply difficulties caused by the HGV driver shortage, Harrow insists.

“We are fortunate we don’t get hit with the issues around short-term delays that the chilled boys do. If you lose a couple of days’ delivery on a chilled load, you could be writing it off. Frozen operates from stock, so you always have that little bit of buffer. If you’re a few days late into your Tesco depot, the chances are they’ve still got stock.”

Not that the category is completely without obstacles. There are, after all, the incoming rules on promoting HFSS products. “We are going to be living in a real new world,” says Harrow.

“Retailers are going to be making changes to merchandising and, of course, if you’re in an ambient category your ability to re-merchandise is much greater than in frozen.”

Top Launch 2021

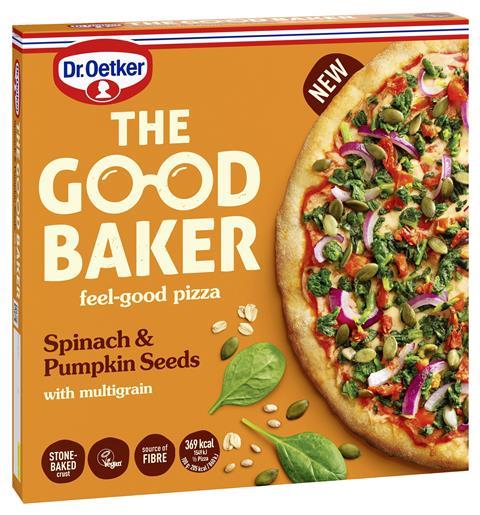

The Good Baker | Dr Oetker

Frozen pizza doesn’t have to be unhealthy. That was the message from Dr Oetker in September as it rolled out The Good Baker – a four-strong range of non-HFSS lines. The likes of Margherita Multigrain with Flaxseeds and Veggie Mix with Sourdough (rsps: £3.69 to £4.19) are meat-free and provide no more than 768kcals per pizza. (Veggie variants of Dr Oetker’s core Ristorante pizzas start at 898kcals.) The supplier’s aim is to “unlock category growth with a new positive health brand” it says.

Topics

The Grocer’s Top Products Survey 2021: who’s up, who’s down – and our overview of the key trends

Covid, Brexit costs and shortages in labour and material have caused chaos in grocery this year. Which sectors are best placed to deal with the inflationary storm on the horizon in 2022?

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

Currently

reading

Currently

reading

Frozen food 2021: growth slows but ice age continues

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

No comments yet