Sales of RTD coffee declined during lockdowns, but as it recovers, what type of shopper is most likely to buy it, where – and at what frequency? How important is price? And how have preferences for plant-based products and eco-friendly packaging made an impact?

This research was commissioned by The Grocer and carried out by Lumina Intelligence independently from Starbucks

Free download: 10 charts explaining UK attitudes to RTD coffee

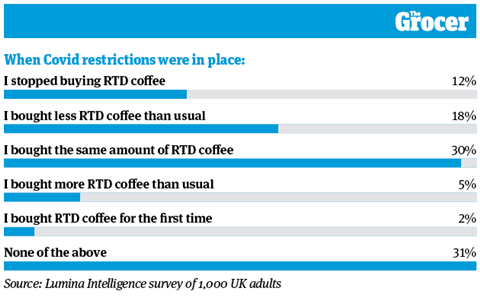

1. 30% of Brits bought less RTD coffee during the pandemic

Ready to drink (RTD) coffee is designed to be a handy on-the-go option. So when Covid restrictions saw commuting decrease and Brits venture out less altogether, frequency of purchase unsurprisingly took a hit.

According to our survey of 1,000 UK adults conducted by Lumina Intelligence, 18% of Brits bought less RTD coffee than usual when restrictions were in place, while 12% stopped buying it altogether. That said, the same percentage (30%) stuck to their purchasing habits during the pandemic, buying the same amount of RTD coffee as usual. Some shoppers even upped their consumption during the period (5%), with 18 to 24-year-olds most likely to fall into this category (16%).

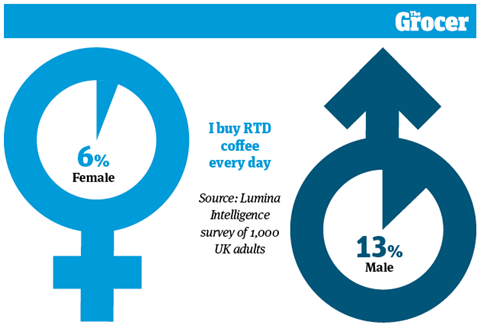

2. Men are twice as likely as women to drink RTD coffee daily

Since the removal of Covid restrictions, 41% of Brits have bought RTD coffee more than once a week. Many are getting their fix two or three times a week (17%), and for 9% it’s a daily habit.

However, men are more likely to fall into the latter habit than women (see right). Our research also suggests men drank a larger amount of RTD coffee during the pandemic. A third drank the same amount during Covid, while 7% drank more than usual. That’s compared with 27% and 4% of women respectively.

Adam Hacking, head of beverages at Starbucks owner Arla Foods, suggests consumers “enjoyed these typically on-the-go drinks in a more informal and relaxed environment” during the pandemic.

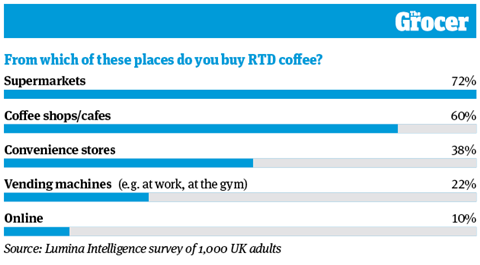

3. Supermarkets are the most popular place to buy RTD coffee

Whether it’s part of their big shop, a meal deal component or an impulse pick-me-up, UK shoppers are most likely to go to the supermarket for their RTD coffee fix. That was the primary destination for 72% of shoppers, while 38% opted for c-stores.

The second most popular destination was coffee shops and cafés, chosen by 60% of respondents, while online was the least popular choice. However, buying online was more preferable to the 25 to 34 age group (19%) than any other.

Vending machines were also most popular with shoppers in this demographic, as well as 35 to 44-year-olds. Thirty per cent of people from both age groups chose to buy from machines in locations such as at work or at the gym.

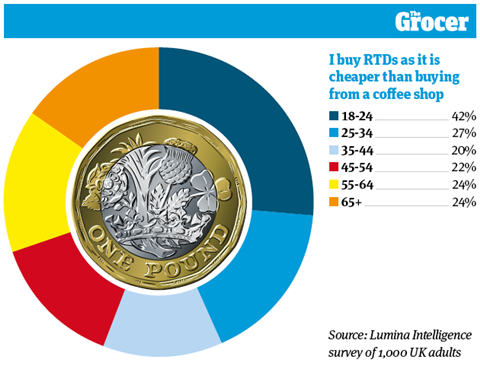

4. Younger shoppers are most driven by price of RTD coffee

The cost of living crisis means price is on everyone’s minds. But it’s not the most important factor when buying an RTD coffee. When presented with a list of reasons why they buy into the category, ‘it is cheaper than buying from a coffee shop’ was the fourth most popular answer (24%) with shoppers, though it overindexed with the youngest age group (42%).

The most popular reason for buying RTD coffee was taste (65%), followed by convenience (42%). Finally, 26% said they bought RTD coffee as a way to enjoy a coffee shop brand they like when not near one of their stores. Arla’s Hacking suggests price is not imperative “as consumption is driven by different need states at different times of day”.

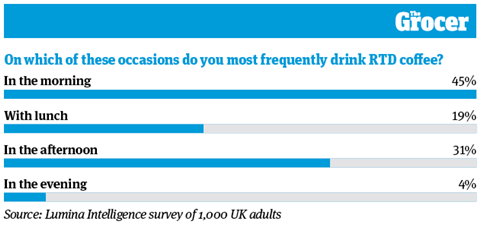

5. Morning is the most common time of day to drink RTD coffee

Many Brits like to kickstart their day with a cup of coffee. And it seems the same goes for the RTD variety, as most respondents prefer to drink in the morning (45%). That said, our survey shows RTD coffee consumption is spread fairly evenly across the day, with plenty of lunch and afternoon occasions.

This correlates with recent NielsenIQ research, conducted in partnership with Starbucks. According to Hacking, the insights “revealed the importance of small transitional moments throughout the day with time-poor consumers looking for an uplift.”

Consumption did drop off in the evening, although more women were more open to this time of day (6%) than men (2%).

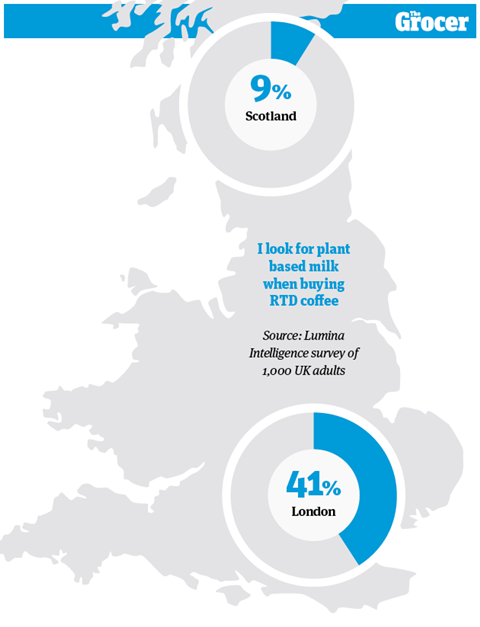

6. Vegan RTD coffee is most sought after in London

According to Arla’s Hacking, the popularity of RTD coffee “can be attributed to the fact it meets more than one consumer need”, including taste, hydration and an energy boost.

Our research backs this up: when asked which features they look for in an RTD coffee, most respondents said flavours (63%), while a third opted for high caffeine content.

The third most sought-after choice was plant-based milk (26%), which overindexed with shoppers in the capital (41%). Milk alternatives are also more popular with younger consumers than older age groups. While 37% of 18 to 24-year-olds said they looked for plant-based milk, that compared with just 13% of over-65s.

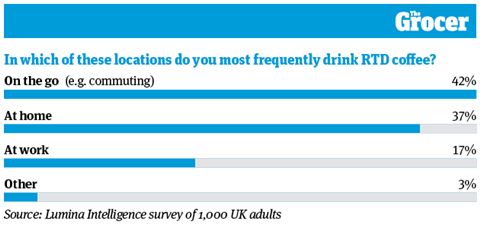

7. Brits drink the most RTD coffee while on the move

We’ve established the most popular time of day to drink RTD coffee (see chart five). Now we can assume many Brits will be drinking it on their morning commute: on the go is the most common location (42%), while 17% wait until they get to work for their coffee fix.

The second most popular place to crack open an RTD coffee was at home (37%), which Hacking believes may have increased in popularity since Covid lockdowns. “During the pandemic, consumers were increasingly looking for ways to enjoy traditionally on-the-go products at home,” he explains.

Citing Kantar data, Hacking says “consumption and household penetration grew throughout 2021”.

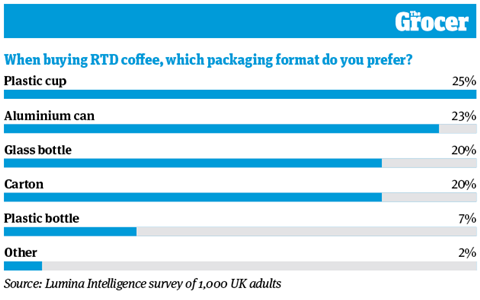

8. Plastic cups are the most popular packaging format for RTD coffee

What war on plastic? According to our survey, the most popular packaging format for RTD coffee is plastic cups, chosen by a quarter of Brits. The format was particularly popular with the 25 to 34 age group (30%). This aligns with Starbucks’ target audience for its Chilled Classic Cups range, which it markets at young professionals.

The second most popular format was aluminium cans (23%) followed by glass bottles and cartons (both 20%). Glass bottles were most popular with 18 to 24-year-olds (34%), while cartons overindexed dramatically with the 65-plus age group (41%).

Plastic bottles were the least popular format, chosen by just 7% of respondents.

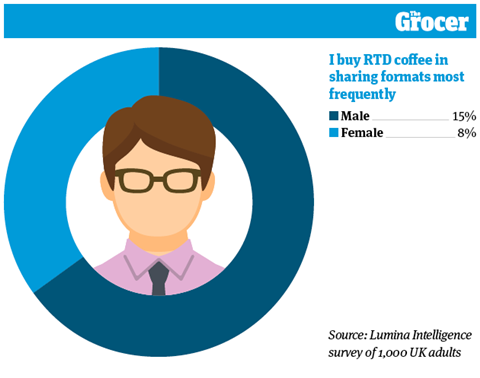

9. Men buy more RTD coffee in sharing formats than women

Single-serve formats remain the most popular way to drink RTD coffee, favoured by 57% of consumers. But sharing packs aren’t to be discounted: they are favoured by 11% of Brits, and are more popular with men (15%) than women.

Sharing packs are also twice as popular with 18 to 24-year-olds (32%) than the next most interested age group, 35 to 44 (16%). Meanwhile, 13% of Brits buy multipacks most often, while 15% split their purchases across a combination of formats.

That’s why Starbucks launched its range of multiserve cartons in January. According to Hacking, the range “was designed in response to consumers’ evolving consumption habits and to ensure the category remained fresh and relevant”.

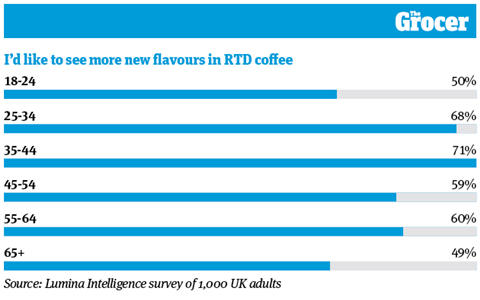

10. 35 to 44-year-olds most keen to see new RTD coffee flavours

We already know flavour is the most sought-after credential for RTD coffee consumers (see chart six). So it’s perhaps unsurprising shoppers want even more choice on this front. When asked what they’d like to see more of in the category, 62% of respondents opted for flavours, with the 35 to 44 age group most keen to see a wider range (71%).

Next up, 29% of Brits wanted to see more plant-based options introduced, while 16% would prefer more decaf options. According to Arla’s Hacking, brands can “ensure retailers make the most of the on-trend and lucrative” flavour subcategory by “continuing to develop and launch relevant and exciting NPD”.

Watch: Starbucks on how to play the cool card in iced coffee

Downloads

10 Charts RTD Coffee

PDF, Size 0.54 mb