Fears of a transatlantic trade war and damaging tariffs of up to 25% on British exports to the US look to be over, for now, after Donald Trump announced the “framework” of a future deal on the issue of Greenland and a suspension of his tariff plan.

However, exporters have warned future trade with the US could continue to be plagued by uncertainty.

Posting to his social media platform on Wednesday evening, after a meeting with NATO secretary general Mark Rutte at the World Economic Forum in Davos, Switzerland, Trump said a deal on Greenland, would “if consummated”, be “a great one for the United States of America, and all NATO nations”.

Trump’s increasingly fevered overtures towards the Danish semi-autonomous territory has ramped up in recent weeks. His administration even refused to rule out using military force to annexe Greenland – a move Denmark’s prime minister Mette Frederiksen warned would be “the end of NATO”.

With the US president repeatedly insisting American ownership of the territory was “needed” for “the purpose of national security”, growing opposition to his calls from NATO allies came to a head last weekend, when Trump threatened to slap a 10% tariff on all US imports from the UK, Denmark, Norway, Sweden, France, Germany, the Netherlands and Finland.

Read more: Trump Greenland tariffs could leave UK food and drink facing £800m hit

The levies were due to come into force at the start of February, rising to 25% from 1 June, and would have been “due and payable until such time as a deal is reached for the complete and total purchase of Greenland”.

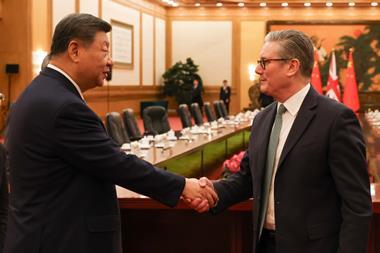

Trump’s proposals provoked a stern response from NATO allies, with prime minister Keir Starmer saying on Wednesday the UK “will not yield” to pressure on the future of Greenland.

But amid mounting opposition from European leaders and pressure from Republican politicians at home, “productive” talks at the WEF led to an apparent breakthrough on Wednesday evening – though detail on what the deal would include is currently thin on the ground.

“Based upon this understanding, I will not be imposing the tariffs that were scheduled to go into effect on 1 February,” Trump said on his Truth Social platform.

Unconfirmed media reports suggest the proposed agreement would give the US full sovereignty over US military bases in Greenland – rather than full ownership of the territory – as seen in Cyprus, where the UK holds two strategically important Sovereign Base Areas.

Implementing the threatened tariffs could have cost UK exporters between £500m and £800m a year, according to Institute of Export & International Trade director general Marco Forgione.

Exporters welcome climbdown

The climbdown will have been welcomed by exporters staring down the barrel of such a steep rise in export costs – which would have ultimately rendered their products uncompetitive in the US market – suggested Food & Drink Export Association chair Barney Mauleverer.

“But the episode has been a stark reminder of how quickly geopolitical tensions can disrupt vital export markets,” he added. “Our sector’s £3bn annual trade with the US is too important to be held hostage to such brinkmanship.

“We will continue to encourage our members to diversify their exports to multiple markets, seek new opportunities especially where free trade agreements are being unlocked and pressing HM government for ironclad safeguards to protect jobs and growth in British food and drink.”

2026 agrifood commodities outlook: how will Trump chaos impact on trade?

Mauleverer’s comments have been echoed by a number of significant UK food and drink exporters, with Wyke Farms MD Rich Clothier this week telling The Grocer his business was “trying to build up contingency stocks in the US”, due to uncertainty over trade policy.

This uncertainty was also “killing” the whisky industry, said Penderyn CEO Stephen Davies, who warned a 25% tariff would have been a “complete disaster for independent distilleries”, with the category being “weaponised in a geopolitical auction that small distillers cannot possibly win”.

US retail and wholesale customers were also increasingly “done” with tariff-based price hikes, following last year’s ‘Liberation Day’ levies, suggested Alan Jenkins, director of dairy exporter Somerdale International.

“If the tariffs would have gone up to 25%, it would have been a struggle” to continue trading relationships with US buyers, he added.

Political commentators are already suggesting the Greenland crisis will not only have weakened NATO, but also diminished trust in the US as a reliable ally and trading partner. And while the threat of tariffs will have been allayed in the short-term, the threat of further trade volatility was never far away, said Forgione.

“The reality is that since January last year, Trump has been very clear of his intention to deliberately unpick the global multilateral system – and that’s also been made abundantly clear in the past few days in speeches at the WEF, from the likes of Canada’s PM Mark Carney,” he added.

“Trade is now a geopolitical weapon and we should expect, while this threat has gone, there is every likelihood on another issue that tariff threats will be used by Trump again.”

No comments yet