That inflation has been a major topic in the UK over the past six months is not a new or ground-breaking statement – but what we are now seeing unfold in stores up and down the country is newsworthy. The latest four-week sales across UK grocery retail indicate we’re at the beginning of a seismic shift in consumer behaviour. So, what’s happening?

We all know that typically, when manufacturers, retailers and wholesalers are faced with inflated costs, prices are increased to mitigate this. The shopper is faced with the bill, pays it, and their cost of living increases. But at the time of writing, that’s not what’s happening.

Faced with inflated costs, manufacturers, retailers and wholesalers have indeed raised their prices. Whilst categories such as dry pasta have seen direct price increases of 20% in the past four weeks, overall we’re seeing inflationary price increases of 3.9% across the board. Crucially, however, significant numbers of shoppers are changing what they buy, rather than paying the increases.

Take an example weekly grocery budget of £100. If inflation goes up the expected 8% and a shopper continues to buy the same items, they’re now spending £108. We would expect some people to trade down, but the majority to stick to their old habits and preferences.

That’s not what’s happening this time. The data – for context, we look at 400,000 products across 30 UK retailers every week – is saying that for the moment, most are managing to maintain their budget at around £102.

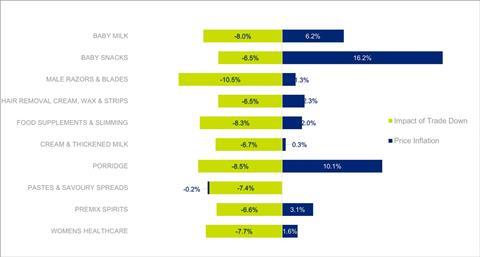

Interestingly, whilst downtrading is happening in some categories where we are seeing high levels of inflation, that’s not the whole picture. We’re also seeing a move to cheaper products in categories with much lower levels of price increase. This suggests shoppers are perhaps proactively choosing cheaper products as a way of managing their overall shop, meaning that increases in category A are impacting what is bought in category B, regardless of how prices are changing.

The table below illustrates this point. You’ll see categories in which shoppers are choosing to buy cheaper products alongside the respective price inflation. Categories seeing the highest levels of downtrading aren’t always seeing high levels of inflation.

Click the expand symbol to view chart full size

IRI inflationary tracking source: all outlets (market sample) 4 w/e 12 Feb 2022

- Impact of trade down: the weighted impact of shopper choice on the average price of consistently available products due to changing needs of in reaction to price changes

- Inflation: the weighted inflationary or deflationary impact of price across all consistently available products, removing year-on-year volume mix change

The numbers above are hot off the press and give us a near real time view of what is happening right now. The initial changes in demand we are seeing at a category level will result in both winners and losers at a brand level. What happens next is crucial, and we are glued to these weekly sales updates as they come through.

There is clearly a more significant mid-term implication if we continue to see this level of change taking place in shopper behaviours. Not only will price increases not flow through in the way anticipated and therefore not help offset the increased cost bases that so many are experiencing, we are seeing millions of shoppers adding and dropping brands from their baskets as they’ve been forced to re-evaluate their brand affinities. These choices aren’t just taking place within categories, but also at a wider level, which will likely result in unexpected and much broader changes to demand.

Right now, we’re not seeing this news in the media because the narrative focuses exclusively on inflation and like-for-like prices increasing. The question ‘how will shoppers cope?’ is being asked, but the question should be ‘how are shoppers coping?’ It’s crucial manufacturers, brands, retailers and wholesalers understand this is the year to look beneath the headlines. Beyond understanding the implications on 2022 P&Ls, we expect to see the ‘winners’ use this as an opportunity to create personalised and targeted campaigns to connect with shoppers.

This all pales into insignificance when we look at what’s happening in Ukraine. But it would be remiss of me not to mention how these events will likely influence what will happen in UK supermarkets. As the world’s biggest producer of organic produce and the largest, or one of the top three, global exporters of sunflower oil, barley, rye, corn, potatoes and wheat, Ukraine is an important player in the global food supply chain. Without Ukraine’s exports, we will see further price hikes and shoppers continuing to make tough decisions to manage household finances over the next 12 to 24 months. We’ll continue to stay close to the detail.

No comments yet