It has been dubbed the “nightmare before Christmas” by British business leaders. But, nearly eight months after the first lockdown was announced back in March, the country now finds itself living under stringent national restrictions once again following a surge in coronavirus cases.

There was a definite feeling of déjà vu and groundhog day this time around. Indeed, talk of panic-buying kicked in almost immediately and pictures of empty supermarket shelves were being shared across the internet following a sharp initial uptick in sales of toilet roll, sugar and dishwashing products.

All of which means the grocery sector must once again adapt and work tirelessly to help keep the country moving at a time when major shifts in shopping habits and consumer trends have also occurred since coronavirus struck.

Arguably, the most important of these trends has been consumers becoming far more fickle in terms of which supermarket they choose to give their business to, meaning brand loyalty has given way to availability.

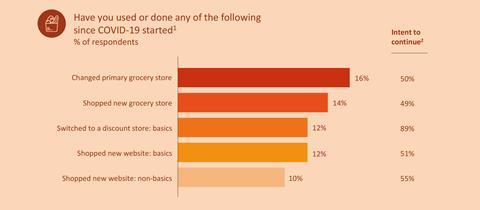

In fact, nearly a sixth of UK consumers have shifted from one brand or retailer to another [1], and approximately half are expected to continue doing so once Covid-19 is brought under control and normality finally returns. Plus, more people than ever plan to make a portion of grocery purchases online post-Covid-19 than they did before, according to McKinsey & Company.

All of this presents unique challenges for grocers, but it also opens up a swathe of new opportunities to tap into. The question is, how do retailers turn these newly acquired customers into loyal shoppers?

Facebook believes the secret to building brand equity during the pandemic is by investing in three fundamental principles: safety, ease and joy.

“Consumers have tried out so many different retailers because they need the process to be safer and easier, and many have connected with brands that have been able to inject a bit of joy into their lives,” Zehra Chatoo, connection planner at Facebook, explains.

“We believe these are the most important ingredients to building brands right now and if a brand doesn’t have that, then it’s going to be an uphill struggle,” she adds.

Safety

Safety has in many ways become the Holy Grail of brand building in the grocery sector in 2020.

Take Maslow’s hierarchy of needs. Whereas brands had previously focused on the top of the pyramid (self-fulfilment needs, for example) to create equity, Covid-19 has since turned this theory on its head. This means consumers are increasingly seeking out the basic needs, such as physiological, safety and belonging.

An online survey found that 66% of UK adults cited safety as the most important reason when deciding where to shop [2]. A separate report in June 2020 also revealed 67% of adults felt that shops not being too crowded made for a great in-store experience – a significant increase from the 40% figure recorded in March [3].

Adopting a clear communication strategy has a big part to play in this quest to keep customers safe, whether it’s messaging about opening hours, caps on products or specific shopping slots for the vulnerable. And how retailers communicate and interact with their customers has undergone rapid change this year as a result of Covid-19, with many companies benefiting from a more digital- and mobile-first approach.

With this in mind, online platforms have given retailers the chance to reach new audiences in creative ways by delivering uncomplicated messages to these customers.

Aldi, for example, used dynamic ads on Facebook to inform customers of when it was the quietest time to visit their local shop, based on where they were located and using transaction data from their stores. This helped flatten the footfall and reduce the need for people to queue outside.

Ease

Coronavirus means the in-store experience is also becoming far more transactional as shoppers look to get in and out of the shop as quickly as possible. As a result, those key moments for discovery and inspiration – in-store deals, offers and promotional bundles – have largely evaporated and many are moving online via retailer websites or social media channels.

“Grocers and brands need to think about where those moments and basket top-ups used to happen and then bring that further up the funnel into the discovery moment,” Katy Clark, Facebook’s head of industry for grocery, says.

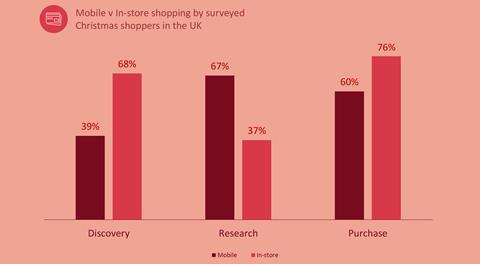

“More than 70% of Christmas gifting happens in-store, for example, so there is a huge gap that the digital shelf needs to bridge and we know that people come to our platforms in a discovery mindset.”

Nearly three-quarters of shoppers decide what to buy before they get to the store [4] and 30% of grocery purchases start with a mobile influence [5]. Investing more in online marketing, therefore, could help customers discover these moments far more easily and seamlessly, such as recipe finders via chatbots or live cookalongs on Instagram stories.

The increasingly transactional nature of in-store shopping means customers are also looking at ways to remove the friction from the purchasing experience. Indeed, research shows it should ideally take five taps or less from when a consumer is thinking about a product to actually making a purchase.

In this regard, supermarkets can use API feeds to deliver intuitive and creative online ads to help customers book available delivery or Click & Collect slots. Many have also focused on producing in-feed ads to drive downloads of their scan & shop apps to reduce those friction points and improve customer safety.

Joy

For all the pessimism over new restrictions, many will also remember how the first lockdown cultivated a renewed sense of community spirit. Friends, families, neighbours, celebrities and even businesses all rallied in solidarity, finding new and creative ways to inject a bit of joy into our lives at the same time as protecting the most vulnerable.

This yearning for positivity saw many grocers step up to the mark. Take Marketing Week’s Brand of the Year, Tesco. The British retailer utilised its Food Love Stories campaign during the pandemic by using a digital-first approach to bring families together online and show that food still knits families and communities together.

Other grocers and fmcg brands used social media to deliver similar moments of joy and create a sense of community, whether that was through hashtags, reader polls or the use of Giphy stickers.

However, the reality of going into lockdown a second time means that this jovial response is likely to be diminished, as a weary British public grows increasingly tired of restrictions on their freedoms.

Indeed, the second lockdown was an eventuality everyone dreaded, yet many glumly predicted. Ironically, the nightmarish news was delivered to the nation by the Prime Minister on a grim Halloween night – the timing of which certainly seemed in keeping with the wider public mood.

“There is an even greater need for us to bring joy to people and we’re seeing it on our platform too,” Facebook’s Chatoo says.

“If we look at the levels of interactions with public posts with the term/hashtags ‘little moments of joy’ or ‘little luxuries’, we see a significant increase with both more than trebling in volume. People are seeking out joy where they can. They are craving it.”

In summary, Facebook believes the opportunity to build brands for grocery sits with investing in the fundamental needs of safety, ease and joy and doing it in a way that drives a deeper emotional connection with your audience.

To find out more, read Facebook’s Future Proofing Grocery report.

SOURCES

1. McKinsey & Company Covid19 UK Consumer Pulse survey 4/3 - 5/3/2020

2. Facebook IQ source: “Consumer Behavioral Micro-Shifts Tracker by Kantar Profiles (Facebook-commissioned online survey of 4,340 online general population respondents ages 18+), Spain, UK, Italy, Germany, France only, May 5-Jun 15, 2020

3. Facebook IQ source: Periscope by McKinsey, Retail reimagined: The new era for customer experience, August 2020 UK data shown n = 441 UK Adults surveyed in early March 2020 and early June 2020

4. Deloitte Consulting LLP, Deloitte digital divide survey; 04/2016

5. Deloitte Consulting LLP, Deloitte grocery digital divide survey; 11/2016