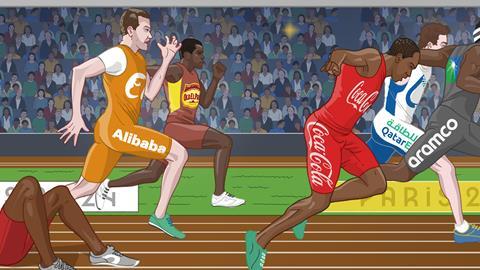

Fmcg brands are facing increased competition in the sporting sponsorship space from a new breed of businesses. What are the implications?

There are fewer than 100 days until the Olympics comes to Paris and, along with the Euros in Germany, there’s a palpable sense of relief among certain sponsors that relative normality is returning to a major sporting event. No awkward questions over labour abuses or LGBTQ+ rights. No need to smile alongside authoritarian figures. No global pandemic to leave stadiums empty. Just a minor sleaze investigation that Parisian organisers promise is all a big misunderstanding. So, let the games begin.

For companies sponsoring these events, the relative normality of Paris and Germany after the likes of the Covid-hit Tokyo Olympics or the controversial World Cup in Qatar should not be underestimated. Given such events are an opportunity to reach up to three billion people, any controversy or disruption can be costly.

Paris will also be the closest global event to British soils for more than a decade, meaning both a favourable time zone and a proximity that sponsors hope will allow Olympic fever to hop across the Channel. That’s why numerous home brands have flooded into the Olympics this year, with sponsorship of Team GB enabling an influx of food and drink sponsors such as Old El Paso, Whole Earth and Birds Eye Green Cuisine.

Each will be paying about £1.2m on average for the privilege, according to GlobalData, and in return will get the opportunity to launch on-pack Olympic promotions, sign personal deals with athletes, and create online campaigns. “The attraction is clear in that you have a three- to six-month window to generate interest in what are usually low-differentiation brands,” says Neil Hopkins, global head of strategy at M&C Saatchi.

To advertise on athletes’ kits or get wider placement in the stadiums, however, costs upwards of £50m. And in the fmcg space, the likes of Procter & Gamble, Coca-Cola, Visa and Alibaba, Carrefour, LVMH, Danone, Decathlon, Le Coq Sportif, Garden Gourmet, Unilever and Westfield are signed up to the various packages.

Olympics and Euros create a summer of sport

Still, while the Paris Olympics and Euros in Germany look more brand friendly, increased involvement in sport from authoritarian countries such as China and Saudi Arabia, accused of ‘sportswashing’ their global reputations by pouring money into hosting major events and sponsoring others, continues to be an issue for western fmcg brands. They must carefully consider their links with events hosted in countries associated with corruption and human rights abuses; and face being outmuscled on sponsorship deals by the seemingly bottomless coffers of state-backed Asian giants.

Such events and deals have become the norm. Fifa has taken its men’s World Cups to Russia, Qatar, and now it appears Saudi Arabia for 2034. And following on, Qatar is now vying to host the Olympics, which have recently been held in Russia and China. Saudi Arabia is turning into a sporting Mecca, hosting boxing fights, Formula 1 races, and a breakaway major golf league – all an effort, its critics say, to boost its soft power in the face of heavily publicised human right abuses. It means the pressure that fell on companies to disassociate with the World Cup in Qatar for its alleged violations of human rights will likely continue.

If there’s a silver lining for major food and drink brands, it’s that public pressure on unhealthy food brands like McDonald’s and Coca-Cola for sponsoring major sports events has now fallen elsewhere.

Fifa, for example, was forced to back down on its plans to make Visit Saudi a major sponsor of last year’s Women’s World Cup after a huge backlash from organisers and players over Saudi Arabia’s criminalisation of same-sex relations, and unequal rights for women.

Principled stand

Some western food and drink companies are also willing to take a stand. Rewe, one of Germany’s biggest supermarket chains, pulled out from its partnership with the German FA before the Qatar World Cup after Fifa banned players from wearing ‘One Love’ armbands in support of LGBTQ+ rights.

The decision came after polling showed half of Germans were in favour of sponsors and politicians boycotting the event. “We stand up for diversity – and football is also diversity,” said Rewe Group CEO Lionel Souque at the time. “Fifa’s scandalous attitude is absolutely unacceptable.”

But they are a rare case. A Coca-Cola spokesperson said during the Qatar World Cup that though “further reform remains to be done… sport has the unique potential to bring the world together and be a force for good”. More recently, PepsiCo has launched itself into the world of Saudi sport, signing a deal with both the men’s and women’s domestic football leagues.

“You have a three to six-month window to generate interest in what are usually low-differentiation brands”

Neil Hopkins, global head of strategy at M&C Saatchi

The dichotomy facing these brands is clear, given polls in a number of countries show many people (half of Brits, according to Institute of Practitioners in Advertising) want businesses to take a stand on such issues. The problem is that many still fear the “go woke, go broke” mantra, says Conrad Wiacek, head of sport analysis and consulting at GlobalData, pointing to Bud Light’s sales hit after Dylan Mulvaney, a transgender influencer, promoted the beer on Instagram, causing a backlash among conservative Americans.

“From a brand point of view, are you willing to risk alienating people based on a principle?” he says. “Nine out of 10 businesses are going to choose the path of least resistance. They’re going to do what benefits them as a brand.”

Read more:

-

WATCH: How can grocery win big during the summer of sport in 2024 and beyond?

-

Sported CEO Sarah Kaye on hidden value of grassroots sports sponsorship

-

How women’s sport has become a sponsor’s dream

It’s not just the location of sports events that’s controversial. Numerous Middle Eastern and other Asian governments have been accused of boosting influence through sponsorship. A report last year by Play the Game, run by the Danish Institute for Sport Studies, identified 314 separate sponsorships from Saudi entities across 21 different sports. Aramco alone, the state oil giant and world’s most profitable company, sponsors 17 tournaments and leagues, including F1, the T20 World Cup in cricket, and Spain’s football league.

The money pouring in from China and the Gulf illustrates the financial heft required by legacy food and drink brands to compete. At the Indian Premier League (IPL), for example, now one of the world’s largest sports events with an audience of half a billion cricket fans, Aramco partnered with last year’s tournament for $9.4m a year, according to Global Data, making it the competition’s second-biggest sponsor.

“Brands from India, China, and the Gulf have limited the ability of western brands to do what they were doing 20 years ago, and that’s just turn up,” says Saatchi’s Hopkins. “The IPL is now a global event, so sponsorship fees have gone through the roof. That means you can’t just rock up as a western legacy brand and say you want to buy your way into Indian cricket.”

Western fmcg not backing down

Asian and Gulf companies have invested in global events for many reasons over the past decade. Some – like Alibaba or Emirates – used them as an opportunity to globalise their brands. Others – like Chinese multinational Wanda Group, Russian state-owned energy company Gazprom, and Qatar Energy – became involved when the events were hosted in their local region. According to Ricardo Fort, former head of global sponsorships at Coca-Cola and founder of Sport by Fort Consulting, “now that the events are coming west, we’re likely to see more European and American brands present at the Olympic Games and World Cups again”.

On this basis, one might expect the Euros to be dominated by western brands. But not so. Of the 13 official global sponsors for this summer’s tournament, Lidl and Coca-Cola are among just seven based in Europe or the US. The rest are Chinese (five) and Qatari (one). Yet this should not be taken as a sign that new Asian competitors are replacing western brands, but rather that Uefa is making space for a larger number of sponsors from new regions. To prove the point, in 2016 there were also seven sponsors from Europe and the US – alongside just three from Asia.

It seems clear that at major sporting events, top-tier food and drink brands show no sign of backing down in the face of these wealthy, if controversial, new entrants. Coca‑Cola is the Olympics’ oldest partner – a relationship dating back to 1928 – and is as entrenched as ever. Meanwhile, Budweiser recently renewed its 38-year partnership with Fifa – despite Qatar’s controversial decision to ban the sale of alcohol in stadiums two days before the first match in 2022.

At the Euros, meanwhile, Unilever and Lidl have opted to sponsor the competition for the first time at an estimated cost of $15m each, according to GlobalData. While Unilever plans to promote the likes of Hellmann’s, Dove, and Lynx through ticket competitions and at official fan zones at the competition in Germany, Lidl has opened a prize draw for young children to accompany the players on to the pitch at the start of games.

“From a brand point of view, are you willing to risk alienating people based on principle?”

Conrad Wiacek, head of sport analysis and consulting at GlobalData

One of the few major casualties of recent years is McDonald’s, which was replaced by Just Eat owner Takeaway.com as the official food sector sponsor at the Euros from 2020. With the cost of worldwide sponsorship estimated to cost more than $100m per Olympics, the US burger giant also cut short its deal with the Games in 2017 in the face of financial pressures, opting to direct cash into menu changes, the launch of delivery, and revamping many of its stores.

It’s not just the cost of sponsorship itself that brands like McDonald’s must consider – activating the sponsorship through advertising and leveraging the hospitality rights is also hugely expensive, says Rick Burton, a professor of sports management at Syracuse University, New York, who served as the chief marketing officer for the US Olympic Committee for the Beijing 2008 Summer Olympics.

Yet despite the costs and the controversy surrounding some host nations and new sponsors, few believe there will be a mass exodus from these events any time soon. These sponsorships still offer “exceptional business results” compared with other marketing initiatives, says Fort. “I would be very surprised if I see them terminating their sponsorships in my lifetime.”

But with Gulf states’ controversial hegemony in sport looking set to continue, the spotlight will continue to shine on those associated with it. Given the financial rewards that sponsorship of the world’s biggest sports events can bring, it’s unlikely we’ll see many more companies follow the example of Rewe and withdraw. Instead, they face a battle to stay on the right side of public opinion while staying relevant as behemoths from the east continue to muscle in on their turf.

Goodbye Asian gambling, hello fmcg brands?

First it was food and drink. Then telecoms. More recently it’s been gambling. So, what sector will dominate shirt sponsorship at Premier League football clubs next? Could we see the return of Walkers, Holsten and Chupa Chups?

From the 2026/27 season, a voluntary ban will be enforced by all clubs on betting companies acting as shirt sponsors – a move that opens the door for new brands to step in. Seven of the 20 top-flight teams currently have deals with betting business, most based in Asia, including Aston Villa, Everton and West Ham.

Cryptocurrency was initially seen as the obvious successor, but with the buzz around it now in decline, it seems less likely. Financial services has also been touted. But what about the food and drink brands that were once so prominent?

There are currently no rules preventing sponsorship either from alcoholic drinks or HFSS brands. The first barrier, says Neil Hopkins at M&C Saatchi, is that shirt sponsorship for the top six or seven teams now costs tens of millions of pounds a year thanks to the teams’ global interest in places like China, India, and the US. “That has basically priced out domestic sponsors.”

That’s not the case at less high-profile clubs, though, meaning costs would be lower, though. “You’re sometimes struggling to get into seven figures,” says Hopkins, “but you have to question what’s the real value there?”

However, what’s happened in Spain suggests fmcg brands might make a comeback. La Liga enforced a similar ban on gambling firms ahead of the 2020/21 season; now telecoms is the most prominent sponsor sector. Fmcg is not far behind, though, appearing on the shirts of three out of the 20 teams.

No comments yet