Brits’ changing breakfast habits continue to take a toll on supermarket sales of cereal. Category volumes have fallen again – this time by 1.5%, or 6.4 million kilos. And 15 of the top 20 brands have seen volumes decline as shoppers opt for other breakfast foods.

“Younger consumers in particular are opting for options that are varied and diverse, making cereal a part of their repertoire along with eggs, pastries and on-the-go options,” explains Julian Barker, head of commercial development for Nestlé Cereals.

At the same time, pressure on the biggest players from smaller, health-focused entrants is intensifying. Challengers such as Lizi’s and Bio&Me now sit just outside the top 20, having recorded significant value gains.

“Consumers are switching to more health-forward options and are increasingly seeking functional benefits,” confirms Yulia Kukhar, NIQ senior insight analyst.

One of the most sought-after benefits is protein, as evidenced by the performance of Fuel10k, which was acquired by Premier Foods in 2023. Value and volumes have soared 27.3% and 28.1% respectively. Its £6.5m gain is the largest of any cereal brand this year.

Fuel10k has benefited in part from a pipeline of NPD including the January launch of non-HFSS Multigrain Hoops with a “high protein and fibre” claim. That was followed by porridge pots in September.

“The pots will help retailers tap the sales opportunity in one of the fastest-growing breakfast formats,” says Christopher Owen, Premier Foods brand director for breakfast.

Similarly, high-protein variants from Weetabix have enjoyed success, the brand says. And its eponymous owner has high hopes for the cereal and porridge pots launched in the summer under its Ufit protein brand.

Then there’s porridge giant Quaker. It reports that volume sales of its Oat So Simple Protein sachets and pots have grown 73.4% over the past 12 months. Traditional oats are enjoying a renaissance as shoppers lean towards healthier, less processed breakfasts, the brand adds.

Other brands have bucked the category’s downward trend without the need for protein. Take Cheerios. Owner Nestlé Cereals puts its 4.3% volume gain down to its £5m ‘Little Wins’ push in early 2025. In October, the brand added Very Berry, its first new variant in three years, which Nestlé says got off to a strong start.

“Looking ahead, this is a highly penetrated category and plays a key role in overall basket spend,” adds Barker. “Its success will lie in attracting pre-family shoppers, encouraging shoppers to trade back into brands, and retaining those who might be switching to other breakfast options.”

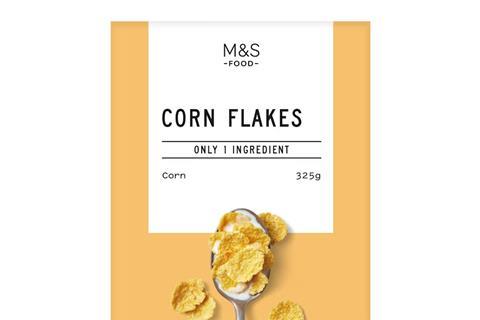

Top Launch 2025

Only 1 Ingredient Corn Flakes | M&S

Ingredients panels don’t get much simpler than just “corn”. In March, against a backdrop of concerns over UPFs and lengthy ingredients lists, Marks & Spencer unveiled its squeaky-clean-label Corn Flakes. The NPD (rsp £2.50/325g) was among the first products in the retailer’s Only… Ingredients range. It also features Multigrain Hoops with five ingredients and Choco Hoops with six. The concept certainly seems to be working: Corn Flakes have performed “really well”, M&S says.

How the psychology of price hikes has played out on shelves

The unwelcome return of inflation has prompted a wide range of tactics. How have shoppers responded and what should brands do next?

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Currently

reading

Currently

reading

Cereal 2025: Rival brekkie options steal cereals’ share

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

No comments yet